The following examples will explain the basic method recording transactions of recording transactions in the form of a journal. Make sure to keep your accounting records in case you get audited. Depending on where you live, you need to keep your records for three to seven years.

Spend more time growing your business

You also need the underlying documents, such as bank statements, receipts, and invoices. Meanwhile loan repayments need to be split into a principal component and an interest component – with each part recorded to Accounting Periods and Methods different accounts. Owner’s contributions and withdrawals also need to be properly documented.

What is a Journal Entry?

You notice there is already a credit in Accounts Payable, and the new record is placed directly across from the January 5 record. Checking to make sure the final balance figure is correct; one can review the figures in the debit and credit columns. In the debit column for this cash account, we see that the total is $32,300 (20,000 + 4,000 + 2,800 + 5,500). The credit column totals $7,500 (300 + 100 + 3,500 + 3,600). The difference between the debit and credit totals is $24,800 (32,300 – 7,500). Having a debit balance in the Cash account is the normal balance for that account.

More from Business Wire

Accountants use special forms called journals to keep track of their businesstransactions. A journal is the first place information is enteredinto the accounting system. A journal is often referred to as thebook of original entry because it is the place theinformation originally enters into the system.

Step 2. Record the transactions

- Consideration must be taken when numbers are inputted into the debit and credit sections.

- This will also help you gain a deeper understanding of the concepts as well.

- Accountants use special forms called journals to keep track of their businesstransactions.

- The Carta platform provides the infrastructure to help fintech and payments business build and manage their payment systems, and it supports prepaid, debit, and credit card issuer processing.

- These entries are initially used to create ledgers and trial balances.

Then, check out our accountant and bookkeeper directory. If you have a staff, give them the tools they need to succeed in implementing the accounting cycle. This could mean providing quarterly training on best practices, meeting with your staff each cycle to find their pain points, or equipping them with the proper accounting tools. The better prepared your staff is, the more efficient they can be.

- TD Bank has also agreed that the monitor will oversee an independent, end-to-end review of its AML Program.

- We will start by walking through the step-by-step process of analyzing and recording service business transactions that follow the debit and credit rules.

- While many companies process payroll on their accounting software, others opt to outsource payroll to companies such as ADP, Paychex, Intuit, or local firms.

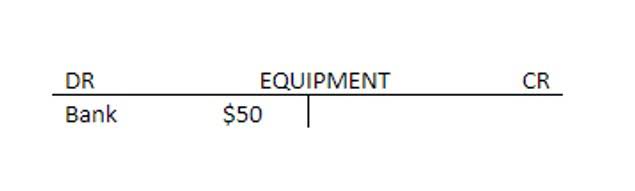

- You can see that a journal has columns labeled debit and credit.The debit is on the left side, and the credit is on the right.Let’s look at how we use a journal.

- But there’s a fat rulebook for how depreciation is done so it’s worth getting a professional to help keep you compliant.

This starts with an understanding of the accounting cycle. TD Bank also failed to timely detect suspicious activity involving its own employees. For example, in 2021, a TD Bank employee facilitated the laundering of narcotics proceeds in exchange for bribes.

- You will then have the opportunity to post transactions from the general journal to the ledger on your own in this module’s graded activity.

- Accounts Receivable has a credit of $5,500 (from the Jan. 10 transaction).

- This is posted to the Unearned Revenue T-account on thecredit side.

- The date of each transaction related to this account is included, a possible description of the transaction, and a reference number if available.

0: Prelude to Analyzing and Recording Transactions

For example, when the company spends cash to purchase a new vehicle, the cash account is decreased or credited and the vehicle account is increased or debited. You will notice that the transactions from January 3, January 9, January 12, and January 14 are listed already in this T-account. The next transaction figure of $2,800 is added directly below the January 9 record on the debit side. The new entry is recorded under the Jan 10 record, posted to the Service Revenue T-account on the credit side. In the journal entry, Dividends has a debit balance of $100.

Analyzing and Recording Transactions

It’s how you track the money flowing in and out of your business, usually in the form of sales and expenses but also from loans and investments. In the journal entry, Accounts Receivable has a debit of $5,500.This is posted to the Accounts Receivable T-account on the debitside. This isposted to the Service Revenue T-account on the credit side. This isposted to the Equipment T-account on the debit side. This is posted to theAccounts Payable T-account on the credit side. This isposted to the Cash T-account on the debit side (left side).

- You will notice that the transactionsfrom January 3 and January 9 are listed already in this T-account.The next transaction figure of $300 is added on the creditside.

- Entry #7 — PGS sells another guitar to a customer on account for $300.

- Having a debit balance in the Cash account is the normal balance for that account.

- You can do this in a journal, or you can use accounting software to streamline the process.

- As part of the settlement, TD Bank admits that it willfully failed to implement and maintain an AML program that met the minimum requirements of the BSA and FinCEN’s implementing regulations.

This process utilizes a standard accounting framework so that the financial operations are comparable to other company’s financial operations. Double check that the numbers in your accounting records match the numbers on your bank statement. Maybe it’s because a business transaction was made using cash, or a different account, or perhaps the money hasn’t actually changed hands yet.